A money order drawer is the person or entity who buys and requests the money order, essentially initiating the payment. They fill out their personal information in the designated “drawer” section, indicating they are the sender of the funds.

Money orders are fantastic for sending payments when you don’t want to use a check or deal with cash. They’re a reliable way to pay bills or send money to someone. But sometimes, the blank spaces on the form can look a little confusing, right? One of those spots is often labeled “drawer.” If you’ve found yourself scratching your head wondering, “What does drawer mean on a money order?” you’re not alone! It’s a common question, and it’s super simple to understand once you know what it’s all about. Think of it as the spot where you, the person sending the money, put your name so everyone knows who’s paying. We’ll break down what the drawer is, why it’s important, and how to fill it out correctly. Get ready to feel confident about using money orders every time!

Are money orders traceable?

Yes, money orders are generally traceable, especially purchased ones from established providers like the United States Postal Service (USPS) or major retailers. When you buy a money order, a record is created, often linked to your purchase receipt and the serial number on the money order itself. This allows the issuer to track its status if it’s lost, stolen, or if there’s a dispute. Keep your receipt! It’s your best friend for tracking your money order.

Understanding the Money Order Form

Before we dive into the “drawer,” let’s get a feel for what a money order looks like. Imagine it as a pre-paid check, but instead of pulling funds directly from your bank account, you pay cash or use a debit card to purchase it beforehand. This makes them a safe option because the funds are already secured.

A typical money order has several key sections:

- The purchaser’s information (that’s where the drawer comes in!).

- The recipient’s information (who you’re sending the money to).

- The amount of the money order.

- A space for a memo or note.

- Serial numbers for tracking.

Each part plays a role in ensuring your payment gets to the right person accurately and securely.

What Does Drawer Mean on a Money Order?

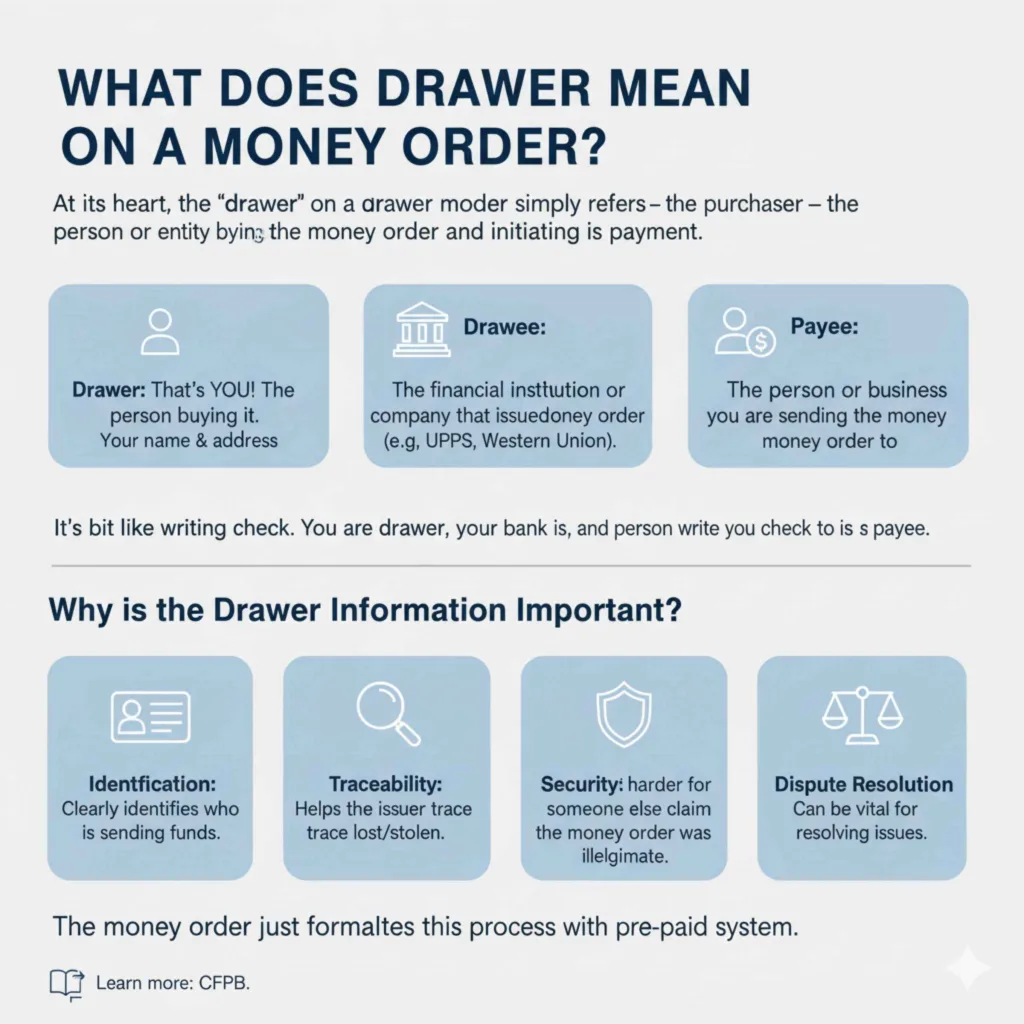

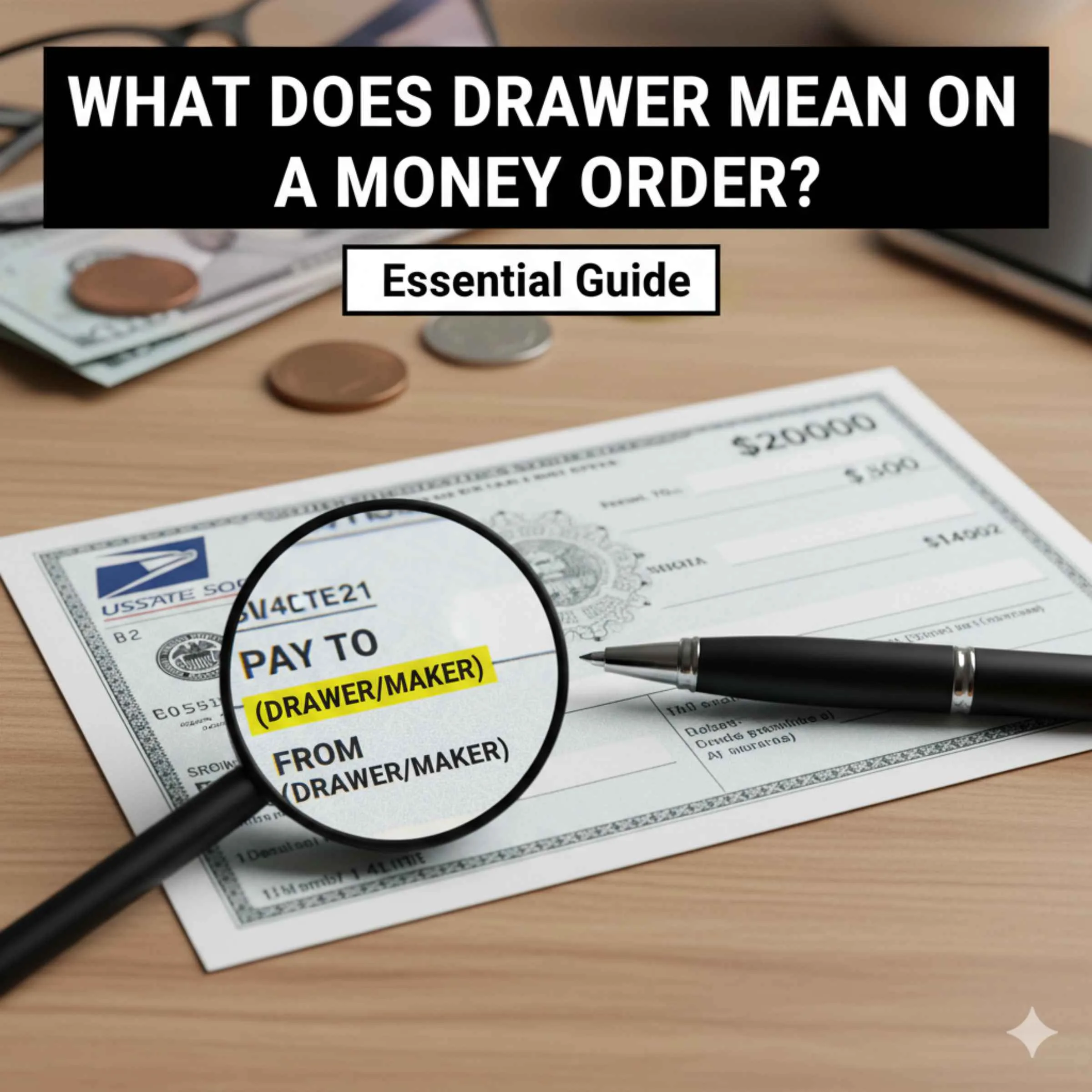

At its heart, the “drawer” on a money order simply refers to the purchaser – the person or entity buying the money order and initiating the payment. When you buy a money order, you are the drawer. This is the space where you’ll write your name and address, identifying yourself as the sender.

Think of it like this:

- Drawer: That’s YOU! The person buying it.

- Drawee: This is usually the financial institution or company that issued the money order (like Western Union, USPS, or a local bank). They are the ones who will ultimately honor the payment.

- Payee: This is the person or business you are sending the money order to.

It’s a bit like writing a check. You are the drawer, your bank is the drawee, and the person you write the check to is the payee. The money order just formalizes this process with a pre-paid system.

Why is the Drawer Information Important?

Filling out the “drawer” section isn’t just busywork; it’s crucial for several reasons:

- Identification: It clearly identifies who is sending the funds. This is important for record-keeping and in case any questions arise about the transaction.

- Traceability: If the money order gets lost or stolen, having your information as the drawer on file helps the issuer trace the document and potentially issue a refund or reissue the payment.

- Security: It adds a layer of security, making it harder for someone else to claim the money order was illegitimate or unauthorized.

- Dispute Resolution: In the unlikely event of a dispute, your information as the drawer can be vital for resolving the issue.

How to Fill Out the Drawer Section Correctly

Filling out the drawer section is straightforward, but doing it right ensures your money order is processed smoothly. Here’s a step-by-step guide:

Step 1: Locate the Drawer/Purchaser Section

When you have your money order form, look for a section that asks for the purchaser’s name and address. This might be explicitly labeled “Drawer,” “Purchaser,” or “Your Name & Address.” It’s usually at the top or on the left side of the form.

Step 2: Write Your Full Name

Clearly print your first name and last name in the designated space. Use legible handwriting. If you’re filling it out for a business, use the official business name.

Step 3: Provide Your Full Address

Next, write your complete mailing address. This includes:

- Your street address.

- Your city.

- Your state or province.

- Your ZIP or postal code.

Ensuring your address is accurate helps the issuer if they need to contact you or if there’s an issue that requires correspondence.

Step 4: Add Your Phone Number and/or Email (Optional but Recommended)

Some money order forms will have a space for your phone number or email address. While not always mandatory, providing this contact information can be helpful for the issuer to reach you if necessary.

Tips for Filling Out Drawer Information Accurately

Print Clearly: Always print using a pen. Avoid cursive if it might be hard to read.

Use Black or Blue Ink: These are the standard colors for official documents.

Double-Check Spelling: Make sure your name and address are spelled correctly.

Don’t Leave Blanks: Fill out all required fields in the drawer section.

Keep Your Receipt: Your purchase receipt usually has a copy of the money order details, including what you filled out in the drawer section. This is your proof of purchase and a crucial reference point.

What About the “Pay to the Order of” Section?

This is a very important area that’s often confused with the drawer. The “Pay to the Order of” section is where you write the name of the person or business you are sending the money order to. This is also known as the payee.

For example, if you are paying your rent to “ABC Properties,” you would write “ABC Properties” in the “Pay to the Order of” box.

Important Note: It is generally not recommended to make a money order out to “Cash.” This can make it as risky as carrying cash, as anyone who possesses the money order can cash it. It’s much safer to make it payable to a specific person or business.

Who is the Drawee on a Money Order?

The drawee is the financial institution responsible for honoring the money order. For example, if you buy a USPS money order, the U.S. Postal Service is the drawee. If you buy a Western Union money order, Western Union is the drawee. You, as the drawer, are essentially instructing the drawee to pay the payee the specified amount. You don’t typically write anything in a “drawee” box, as it’s predetermined by the provider of the money order.

When Do You Need to Fill Out the Drawer Information?

You need to fill out the “drawer” information at the time of purchase or when you’re completing the money order form.

At the Point of Sale: Many vendors, like USPS post offices or retailers, will ask for your information as you buy the money order. They may fill it out for you or provide a form for you to complete.

Pre-filled Forms: If you receive a blank money order form (less common for purchasers), you would fill out all sections yourself before giving it to the payee.

It’s part of the process of ensuring the transaction is legitimate and traceable.

Money Order Security Features

Money orders are designed to be secure. Most reputable providers include various security features to prevent fraud. These can include:

- Watermarks: Similar to currency, official money orders might have watermarks visible when held up to the light.

- Microprinting: Tiny text that is difficult to replicate.

- Holograms: Special visual effects that are hard to counterfeit.

- Unique Serial Numbers: Each money order has a unique serial number that is tracked by the issuer.

- Security Threads: Some may have embedded threads.

Knowing what these features are can help you identify a genuine money order and avoid counterfeit ones. You can often find information about the security features of specific money order providers on their official websites. For instance, the USPS Money Orders page details their security measures.

Common Mistakes to Avoid When Filling Out a Money Order

Even with simple forms, mistakes can happen. Being aware of common pitfalls can save you trouble:

Mistake 1: Forgetting to Sign: While the drawer section usually involves printing your name and address, some money orders may have a separate signature line for the purchaser. Always check.

Mistake 2: Making it Payable to “Cash”: As mentioned earlier, this significantly reduces security. It’s best to name a specific payee.

Mistake 3: Incorrect Amount: Ensure the written amount matches the numerical amount exactly. This prevents confusion or potential disputes.

Mistake 4: Forgetting to Record the Serial Number: Before handing over the money order, jot down its serial number and keep it with your receipt. This is vital for tracking.

Mistake 5: Incomplete Drawer Information: Leaving fields blank in the drawer section can cause delays or issues if the money order needs to be tracked or replaced.

Money Orders vs. Other Payment Methods

Let’s briefly compare money orders to other common payment methods so you can see why the “drawer” information and the money order itself are useful.

Money Order vs. Personal Check

A personal check draws directly from your bank account. If you don’t have sufficient funds, the check can bounce, leading to overdraft fees and returned payment charges. A money order, however, is pre-paid. The funds are guaranteed by the issuer, making it more reliable for the recipient. The “drawer” information on a money order serves a similar purpose to your signature and address on a check, but it’s fixed upon purchase.

Money Order vs. Cashier’s Check

A cashier’s check is also a guaranteed form of payment, but it’s typically issued directly by a bank, and the funds are drawn from the bank’s own account. They are often used for larger transactions like buying a car or a house. Money orders are generally for smaller amounts and can be purchased at more locations, like post offices and retail stores. The concept of a “drawer” applies more directly to personal checks and money orders than cashier’s checks, which the bank officially issues.

Money Order vs. Wire Transfer

Wire transfers are electronic and fast but usually involve fees and require specific bank details of the recipient. They are highly secure but lack the tangible paper trail of a money order. For sending payments when you don’t have bank access or prefer a more traditional method, a money order is a great alternative.

Money Order vs. Payment Apps (e.g., PayPal, Venmo, Zelle)

Payment apps are convenient for digital transactions, especially for friends and family. However, they require both parties to have accounts with the same service and often linked bank accounts or cards. They also can have limits, and disputes can sometimes be complex. Money orders offer a physical, widely accepted payment method that doesn’t require digital accounts for either the drawer or the payee.

Where Can You Buy Money Orders?

Money orders are widely available. Here are some common places:

- U.S. Postal Service (USPS): Often the most affordable and widely recognized option.

- Major Retailers: Stores like Walmart, CVS, Walgreens, Kroger, and many others sell money orders.

- Convenience Stores: Many local convenience stores and check-cashing services offer them.

- Banks and Credit Unions: While some banks offer their own money orders or cashier’s checks, others may not. It’s best to check with your specific branch.

The issuer (the drawee) will vary depending on where you purchase the money order. Always check the fees, as they can differ between providers.

What If My Money Order is Lost or Stolen?

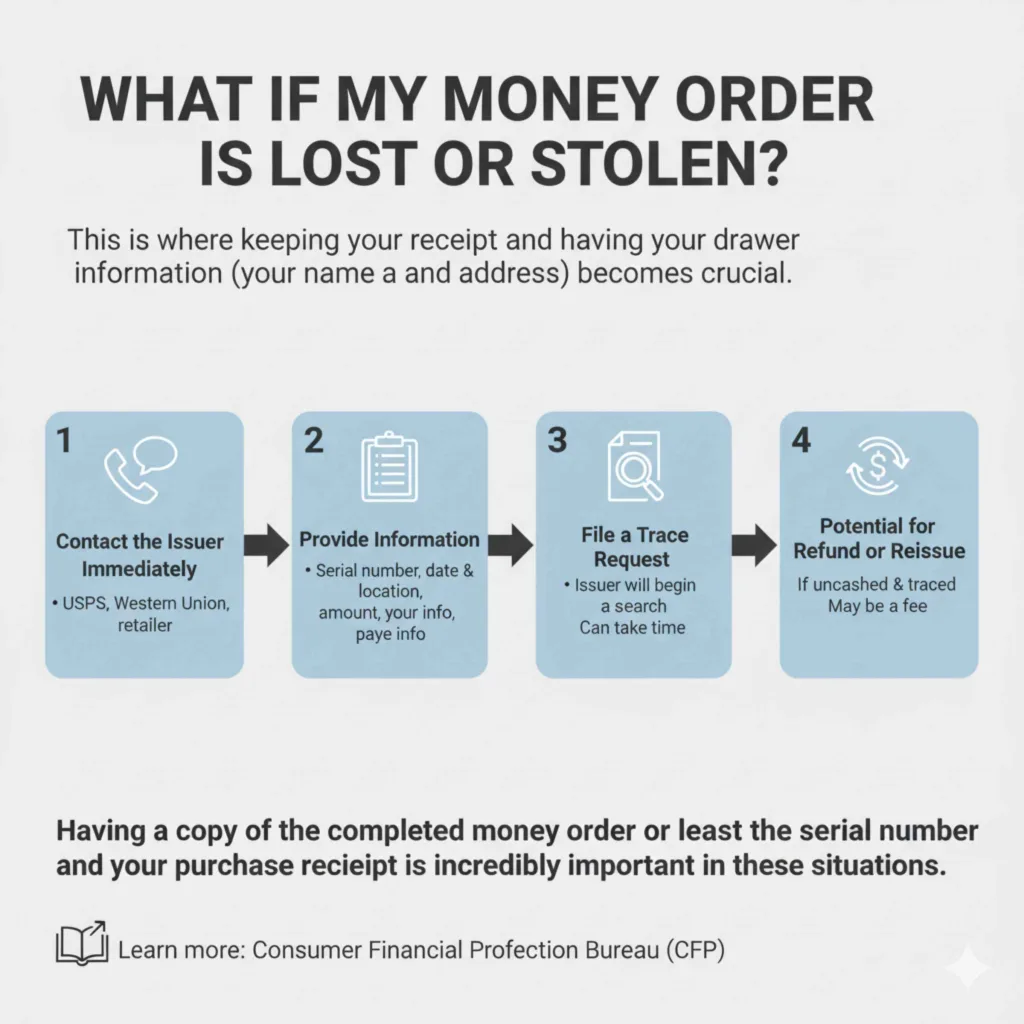

This is where keeping your receipt and having your drawer information (your name and address) recorded becomes crucial.

1. Contact the Issuer Immediately: If you realize your money order is lost or stolen, contact the company you purchased it from (e.g., USPS, Western Union, the retailer).

2. Provide Information: You’ll need to provide as much detail as possible, including:

The money order serial number.

The date and location of purchase.

The amount of the money order.

Your name and address (the drawer information).

* The payee’s name and address (if you know it).

3. File a Trace Request: The issuer will likely have a process for tracing lost money orders. This can take time.

4. Potential for Refund or Reissue: If the money order is found to be uncashed and is successfully traced, the issuer may refund you the amount or reissue a new money order. There might be a fee for this process.

Having a copy of the completed money order or at least the serial number and your purchase receipt is incredibly important in these situations. The Consumer Financial Protection Bureau (CFPB) also offers guidance on consumer financial products, which can be very helpful.

Frequently Asked Questions about Money Orders

What is the role of the drawer on a money order?

The drawer on a money order is the person or entity who buys it. They are the sender of the payment and fill out their personal information in the designated section.

Do I need to provide my address when buying a money order?

Yes, you generally need to provide your full name and address in the “drawer” or “purchaser” section. This helps in identifying you as the sender and is important for tracking or in case of any transaction issues.

Can I make a money order payable to “Cash”?

It is strongly advised against making a money order payable to “Cash.” This makes it no more secure than carrying physical cash and can lead to fraud. Always make it payable to a specific person or business (the payee).

What happens if I make a mistake filling out the drawer section?

If you notice a mistake before completing the purchase, ask for a new money order. If you make a mistake after purchasing, and it’s a minor error (like a typo in your address), contact the issuer. If it’s a significant error or the payee information is wrong, you may need to go through a trace and reissue process. It’s best to be accurate from the start.

Is the drawer the same as the payee?

No, the drawer is the person buying the money order (the sender), while the payee is the person or business receiving the money order (the recipient).

How can I be sure a money order is legitimate?

Look for security features like watermarks, microprinting, or holograms. Purchase money orders only from reputable sources like the USPS or well-known retailers. Be wary of money orders that seem unusually formatted or lack security features. If you have doubts, you can always ask the issuer about their verification process.

What if the buyer forgets to fill out the drawer section?

If the drawer section is left blank, the money order might be invalid or difficult to trace if issues arise. Banks and issuers usually require this information to process the money order correctly and to have a record of the sender. It’s essential for the buyer (drawer) to complete this part.

Conclusion

So there you have it! Understanding what “drawer” means on a money order is all about recognizing yourself as the person who purchased and initiated the payment. It’s a key piece of information that helps ensure your transaction is secure, traceable, and legitimate. By simply filling out your name and address accurately in the drawer section, you’re taking a critical step in making sure your money order gets to the right place without a hitch.

Remember to always keep your money order receipt and note the serial number – these are your best friends if any unexpected issues pop up. Money orders are a fantastic, reliable tool for sending payments, and now you’re equipped with the knowledge to use them confidently. Whether you’re paying rent, sending money to a family member, or settling a bill, you can feel good knowing how the process works and how your role as the drawer is essential. Happy paying!

Leave a Reply