Is working under the table legal? No, receiving payment for work “under the table”—without reporting income or paying required taxes—is generally illegal in the United States and most developed economies, leading to potential penalties for both the employee and the employer.

Ever heard someone mention getting paid “under the table”? It sounds tempting—more cash in your pocket right now, maybe avoiding some paperwork. If you’re new to the working world, or just trying to earn a little extra money fixing cars or doing side jobs, you might wonder if this practice is truly legal. It’s a common question, and understanding the rules is key to keeping your finances safe and sound. Don’t worry; we’re going to break down exactly what “under the table” means in simple terms. We will look at the risks involved so you can make smart, confident decisions about your work and income.

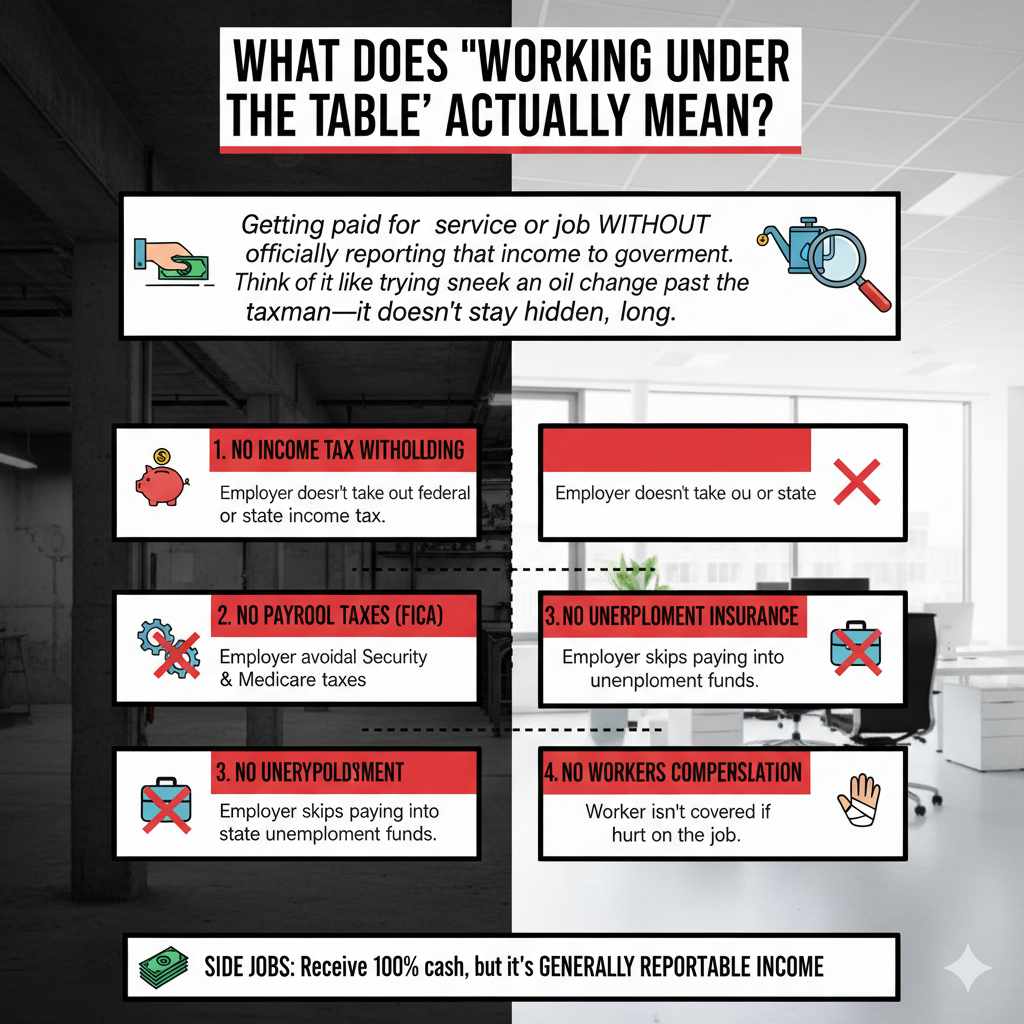

What Does “Working Under The Table” Actually Mean?

When we talk about working “under the table,” we are talking about getting paid for a service or job without the employer or the worker officially reporting that income to the government. Think of it like trying to sneak an oil change past the taxman—it doesn’t stay hidden for long.

This usually means a few key things are being skipped:

- No Income Tax Withholding: The employer doesn’t take out federal or state income tax from your paycheck.

- No Payroll Taxes: The employer avoids paying their share of Social Security and Medicare taxes (FICA).

- No Unemployment Insurance: The employer skips paying into state unemployment funds.

- No Workers’ Compensation: The worker isn’t covered by insurance if they get hurt on the job.

For someone doing a side job, like helping a neighbor detail their car or performing small repairs, this often means they receive 100% of the agreed-upon cash amount immediately. While this might seem like a simple cash exchange, the moment that income is earned, it generally becomes reportable income.

The Legality Breakdown: Is Working Under The Table Legal?

To give you the direct answer: No. In the United States, working under the table is not legal because it violates federal and state tax laws. The Internal Revenue Service (IRS) requires that almost all income earned must be reported, and taxes must be paid on that income.

This isn’t just about income tax; it involves several areas of law where both the person paying and the person getting paid can face trouble.

For the Employee (The Worker)

If you are receiving cash wages and not reporting them on your tax return (usually on Schedule C if you are self-employed, or Form 1040), you are underreporting your income. This is considered tax evasion.

Here are the potential consequences for the worker:

- Back Taxes and Penalties: The IRS can audit you, demand you pay all the back taxes you owed, plus interest, and often add significant failure-to-file or failure-to-pay penalties.

- Audit Risk: Consistently earning unreported income raises red flags during audits.

- Loss of Benefits: If you are collecting government benefits (like unemployment or certain types of disability), earning unreported income can disqualify you, and you may have to repay those benefits.

For the Employer (The Payer)

The employer often faces even steeper penalties because they are responsible for withholding and paying employment taxes. They are avoiding paying:

- Social Security and Medicare taxes (FICA).

- Federal Unemployment Tax (FUTA).

- State unemployment taxes.

- Workers’ compensation insurance premiums.

If an employer is caught paying under the table, they face fines, back tax payments, and potential criminal charges for willful evasion. They are also liable for the employee’s share of FICA taxes they should have withheld.

When Is Cash Payment Okay (And Legal)?

It’s important not to confuse “under the table” (which means intentionally hiding income) with simply being paid in cash legally. You can absolutely get paid in cash legally, as long as you report it.

For example, if you do a quick repair for a friend and they pay you $100 in cash, this is fine, provided you record that $100 as income and report it when you file your taxes.

Here is a simple comparison:

| Scenario | Legality Status | What Needs to Happen? |

|---|---|---|

| Getting $50 cash for mowing a lawn, and you report it on Schedule C. | Legal | Report the $50 income during tax season. |

| Working 20 hours for a small shop, getting paid $250 cash, and keeping it secret from the IRS. | Illegal (Under the Table) | Employer avoids payroll taxes; employee avoids income tax. High risk. |

| Receiving a paycheck with taxes already taken out (W-2 income). | Legal | Taxes are handled by the employer automatically. |

The crucial difference lies in intent and reporting. If you intend to report the income, paying or receiving cash is just a payment method, not a crime.

Understanding Tax Obligations for Side Gigs (The “Gig Economy”)

Many people encounter the “under the table” issue when they start doing side work—maybe you tune up a few cars on the weekend or drive for a ride-share service. These earnings must be reported. As a self-employed individual, you are responsible for paying both the employee and employer portions of Social Security and Medicare taxes. This is known as Self-Employment Tax.

For detailed guidance on self-employment tax obligations, you can always refer to the official IRS guidelines for self-employed individuals.

The key filing requirement to remember is the $400 threshold. If you earn $400 or more in net earnings from self-employment in a year, you generally must file a tax return and pay self-employment tax.

The Hidden Risks of Working Under The Table (Beyond Taxes)

While avoiding taxes sounds like saving money, the risks involved go far beyond just owing the IRS later. When you work “off the books,” you lose critical protections that regular employees receive.

1. No Workers’ Compensation Coverage

This is a massive danger, especially in physical jobs like auto repair. If you are changing oil or using heavy equipment for a job and suffer an injury—say, you drop an engine hoist on your foot—you have no safety net.

- With Coverage: Your medical bills are covered, and you may receive temporary disability pay while recovering.

- Without Coverage: You pay 100% of your medical costs out of pocket, and you have no income replacement if you can’t work.

2. No Unemployment Benefits

If the job ends suddenly, or if the employer decides not to pay you for the work you completed, you have virtually no legal recourse to collect that money because the employment relationship was never officially documented. Furthermore, if you are laid off from a legitimate job, you cannot claim unemployment benefits if your “under the table” earnings are not reported, as your total verifiable income history will be incomplete.

3. Difficulty Securing Loans or Housing

Banks and lenders want to see consistent, documented income when you apply for a mortgage, a car loan, or even rent an apartment. If you only have a stack of cash receipts and no bank deposits showing regular income, you might be turned down for financing, even if you earn a high income.

4. No Retirement or Benefits Matching

Legitimate employers often offer 401(k) matching or simple retirement plans. Working under the table means you miss out on these valuable benefits that help secure your future.

How To Handle Cash Payments the Right Way (The Confident Driver’s Approach)

As a driver or someone doing side work, you want to handle money professionally. Here is a simple, step-by-step guide to ensure any cash you receive is reported correctly and keeps you safe.

Step 1: Track Everything Meticulously

Even if the payment is cash, treat it like a formal transaction. Keep a detailed log for every job.

- Record the date the work was done.

- Note the client’s name and contact information.

- Write down the specific service provided (e.g., “Brake pad replacement on Honda Civic”).

- Record the exact amount received.

Step 2: Issue a Receipt or Invoice

Always give the customer a receipt, even if they pay cash. This protects you if they dispute the charge later. You can buy simple receipt books or use a free template online. Make two copies: one for them, one for your records.

Step 3: Separate Business Funds

This is key for keeping track and looking professional. Do not mix your personal spending cash with your business earnings. Open a separate, free business checking account. Deposit all work-related cash into this account immediately.

Step 4: Pay Quarterly Estimated Taxes

Since no employer is taking taxes out for you, the government expects you to pay taxes throughout the year. If you expect to owe $1,000 or more in taxes for the year, you usually need to pay estimated taxes four times a year (quarterly).

The deadlines are usually April 15, June 15, September 15, and January 15 of the following year. This prevents a huge, stressful tax bill come April.

Step 5: Deduct Your Expenses

The great benefit of reporting your income is that you can deduct your business expenses. If you are fixing cars, you can deduct:

- The cost of parts you bought for the job (if the client didn’t reimburse you).

- Tools you purchase for business use.

- Mileage driven to pick up parts or drive to the job site (check IRS rules on mileage rates).

Deducting these costs lowers your taxable income, meaning you pay tax only on your profit, not your total earnings. This is a major advantage over being paid under the table where you cannot deduct anything.

Employer Perspective: Avoiding Payroll Pitfalls

If you are the one paying someone for work, perhaps hiring a helper for a big weekend project, you need to know the difference between hiring a legitimate employee and hiring an independent contractor. Misclassifying an employee as a contractor (or paying them cash to avoid paperwork) is a major legal risk for the business owner.

The IRS uses several tests to determine if someone is an employee or a contractor. Generally, if you control what work is done and how the work is done, they are an employee and require W-2 forms and tax withholdings.

Here is a quick look at the IRS factors:

| Factor | Independent Contractor (Usually 1099) | Employee (Usually W-2) |

|---|---|---|

| Behavioral Control | Controls how the job is done. | Employer directs the specific work details. |

| Financial Control | Incurs own business expenses; sets own rates. | Paid a set wage/salary by the employer. |

| Relationship Type | Works for multiple clients; offers services to the public. | Works primarily for one employer; relationship is ongoing. |

Failing to report payments to workers who should have been W-2 employees puts the employer at risk for back FICA taxes, penalties, and potential wage claims.

What If I Am Paid Under The Table While Collecting Unemployment?

This is one of the riskiest situations. Unemployment insurance is designed to provide temporary support while you actively look for work. If you take a job, even “under the table,” and you are still collecting unemployment benefits, you are committing fraud against your state’s unemployment agency. You must report any earnings—cash or otherwise—during the week you received them, even if the job was temporary or informal. Failing to report this income can lead to severe penalties, including having to pay back all benefits received and potential criminal charges.

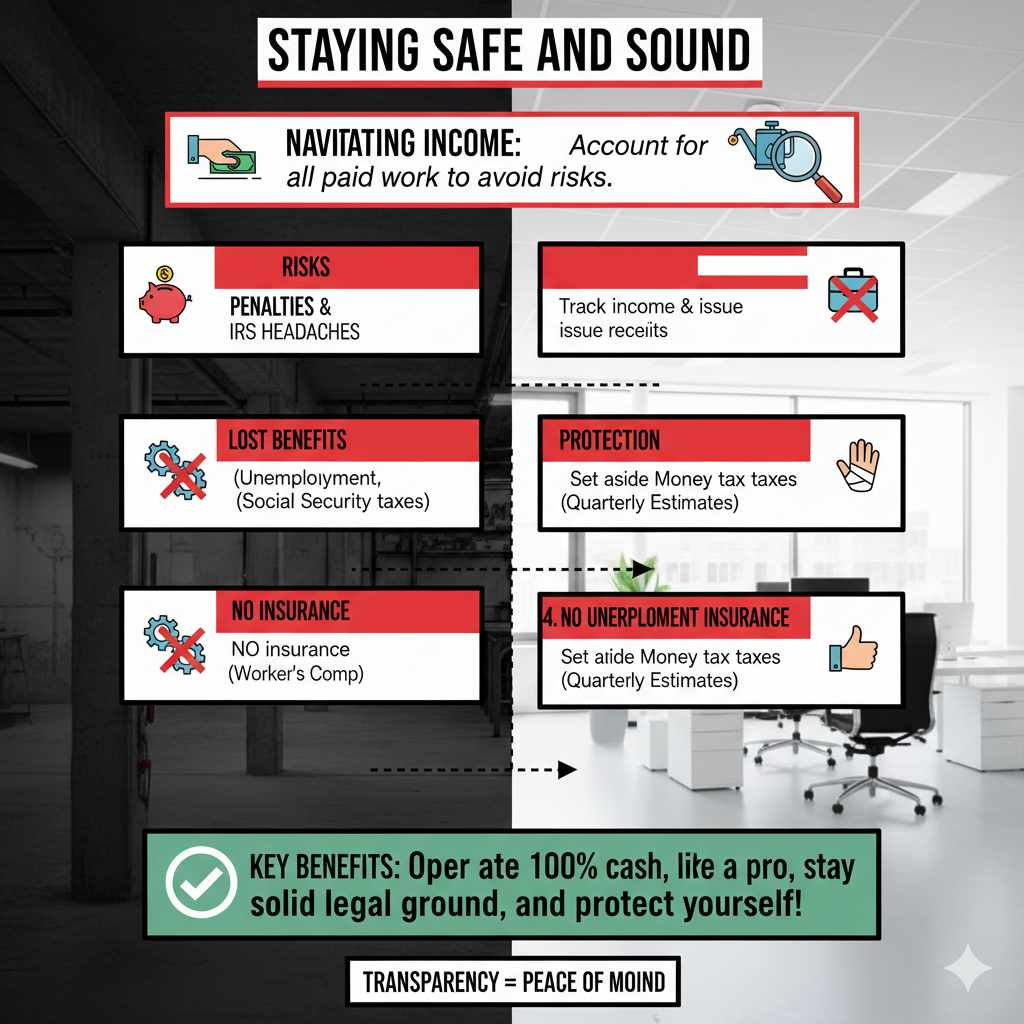

Staying Safe and Sound on the Road and at Work

Navigating income, especially side income, can feel complicated, but the main takeaway is simple: If you are paid for work, that money needs to be accounted for. While the term “working under the table” sounds sneaky and quick, the risks—penalties, lost benefits, and no insurance protection—far outweigh the short-term benefit of avoiding paperwork.

By tracking every job, issuing receipts, and setting aside money for quarterly estimated taxes, you operate your side hustle like a true professional. You build a solid financial history, avoid IRS headaches, and ensure you are protected if something goes wrong on the job. Keep your income transparent, and you can focus on what you do best, knowing you’re on solid, legal ground.

Frequently Asked Questions (FAQ)

Q1: If I only make a couple hundred dollars this way, do I still have to report it?

A: Yes. If you are self-employed, you generally must report all net earnings over $400. Even small amounts add up, and the IRS expects transparency regardless of the total sum.

Q2: If I get paid cash for fixing a neighbor’s car, am I an employee or self-employed?

A: If you set your own hours, use your own tools, and decide how to do the repair, you are considered self-employed (an independent contractor). You are responsible for reporting that income yourself.

Q3: Will the IRS really find out if I don’t report $500 in cash?

A: The IRS has many ways to find unreported income, including tips from clients, bank activity scrutiny, or industry pattern analysis. It is always safer and less stressful to self-report the income proactively.

Q4: What happens if an employer pays me under the table and then refuses to pay me at all?

A: Since there is no official record, it becomes a “he said, she said” situation. If you have receipts or clear communication showing the agreed wage, you might be able to file a claim with your state’s labor board, but it is much harder to prove than with a W-2 job.

Q5: Does working under the table affect my ability to get health insurance through the marketplace?

A: Yes. If you are applying for subsidies on health insurance marketplaces, your income verification is crucial. Not reporting cash income can lead to inaccurate subsidy calculations or future repayment requirements if your true income is later discovered.

Q6: If I work under the table, does that mean I don’t get Social Security credit for that work?

A: Correct. Since no FICA taxes are paid on that income, that time generally will not count toward your future Social Security retirement benefits or disability coverage.

Conclusion

Working “under the table” may seem convenient, but it is generally illegal and exposes both workers and employers to serious financial, legal, and personal risks. Unreported income violates tax laws, can lead to audits, penalties, and back taxes, and strips workers of essential protections like workers’ compensation, unemployment benefits, Social Security credits, and income verification for loans or housing.

Getting paid in cash itself is not illegal—the problem arises when that income is intentionally hidden. By properly tracking earnings, reporting income, paying required taxes, and deducting legitimate expenses, individuals can earn side income legally and safely. In the long run, transparency protects your finances, your benefits, and your future far more than the short-term appeal of unreported cash.